Drawing from my experiences as a former startup founder, a product manager at frog, and now a venture capitalist, I've witnessed firsthand the impact that a deep understanding of market sizing can have on guiding decisions and attracting investment. Let’s dive deep into the trinity of TAM, SAM, and SOM.

Process for Sizing

Top-Down

This methodology, anchored in macro-economic perspectives, offers an insightful lens through which to view your market potential. Let's delve deeper into its intricacies.

1. The Essence of Top-Down Estimation

At its core, a top-down estimate commences at the broader, macro-economic plane and progressively refines its scope, culminating in a granular understanding of what market share a startup could realistically secure.

2. The Power of External Intelligence

To execute this method with precision, one often turns to external market reports crafted by seasoned industry analysts. These documents are goldmines of information, distilling vast amounts of data into actionable insights for founders like yourselves.

3. The Multifaceted Areas of Examination

Diving into a top-down analysis is akin to embarking on a comprehensive research expedition. Your areas of inquiry might encompass:

- Consumer behavior and prevailing trends.

- Demographic data illuminating the composition of potential customers.

- Economic indicators like GDP growth, trade balances, and fluctuations in raw material prices.

- Results from surveys that shed light on market sentiments.

- Insights into industrial activities and energy consumption patterns.

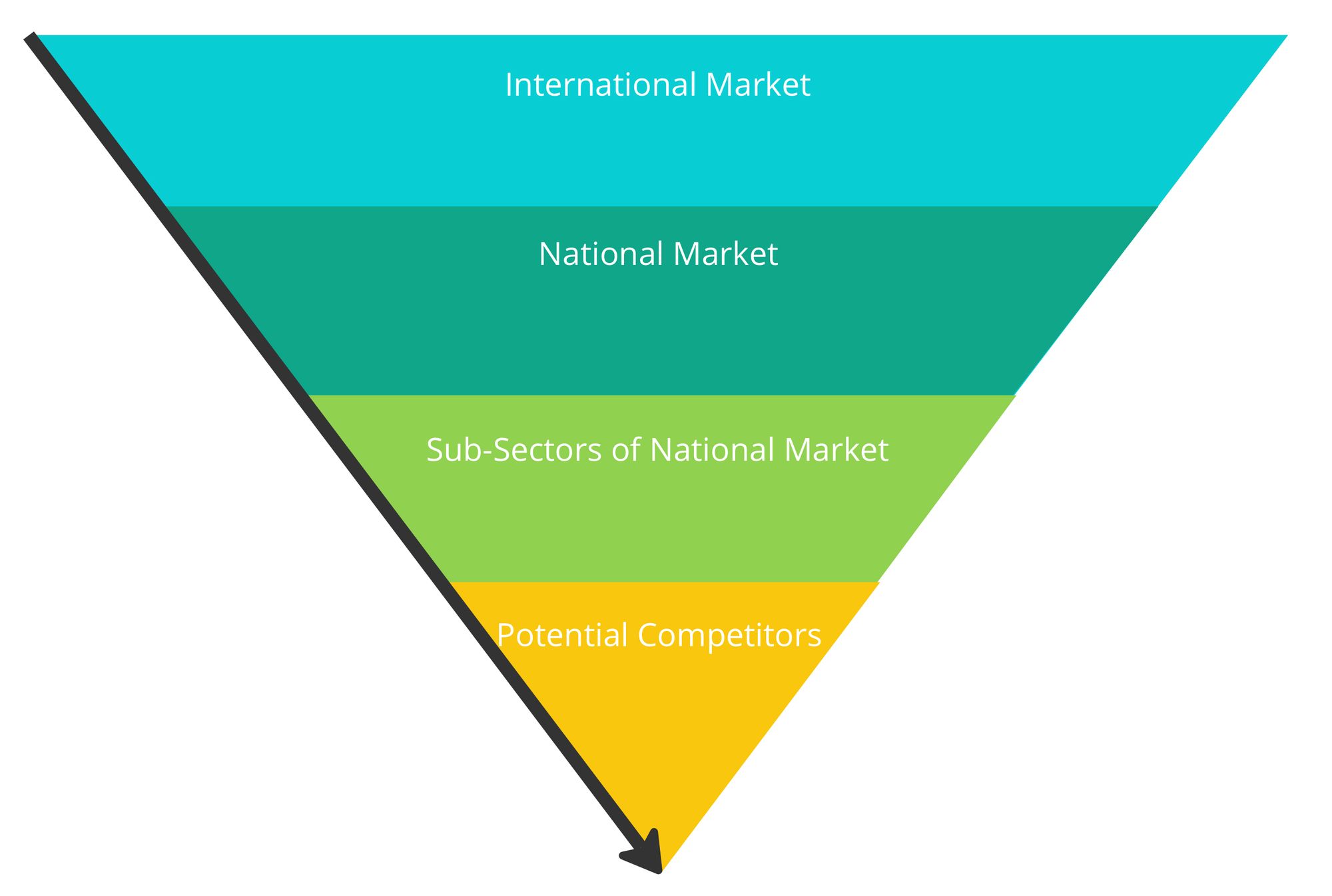

4. A Structured Approach to Analysis

To ensure robustness in your estimations, a methodical progression is advised:

- Begin by examining the global market landscape in its entirety.

- Gradually narrow down to individual national economies, understanding their unique dynamics.

- Dive deeper into specific sub-sectors within these national markets.

- Conclude with a meticulous assessment of potential competitors operating within these niches.

Bottom-Up

An intuitive methodology, the bottom-up approach offers a distinct vantage point, building upon tangible business metrics to paint a broader market picture. Let's examine its intricacies and potential advantages.

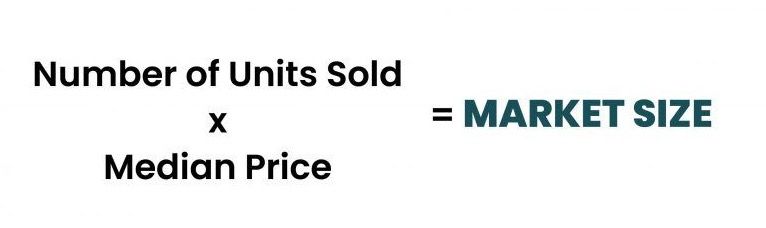

1. The Essence of Bottom-Up Estimation

Contrary to its top-down sibling, the bottom-up analysis commences at the foundational level. It gleans insights from core business metrics—such as the number of customers, volume of products sold, and average pricing. These insights serve as building blocks to extrapolate and gauge the overarching market landscape.

2. The Strength of Grounded Data

The hallmark of this technique lies in its reliance on tangible data. By drawing from actual sales figures and existing offerings in the market, it's often perceived as offering a more accurate reflection of market potential. Real-world data seldom misleads.

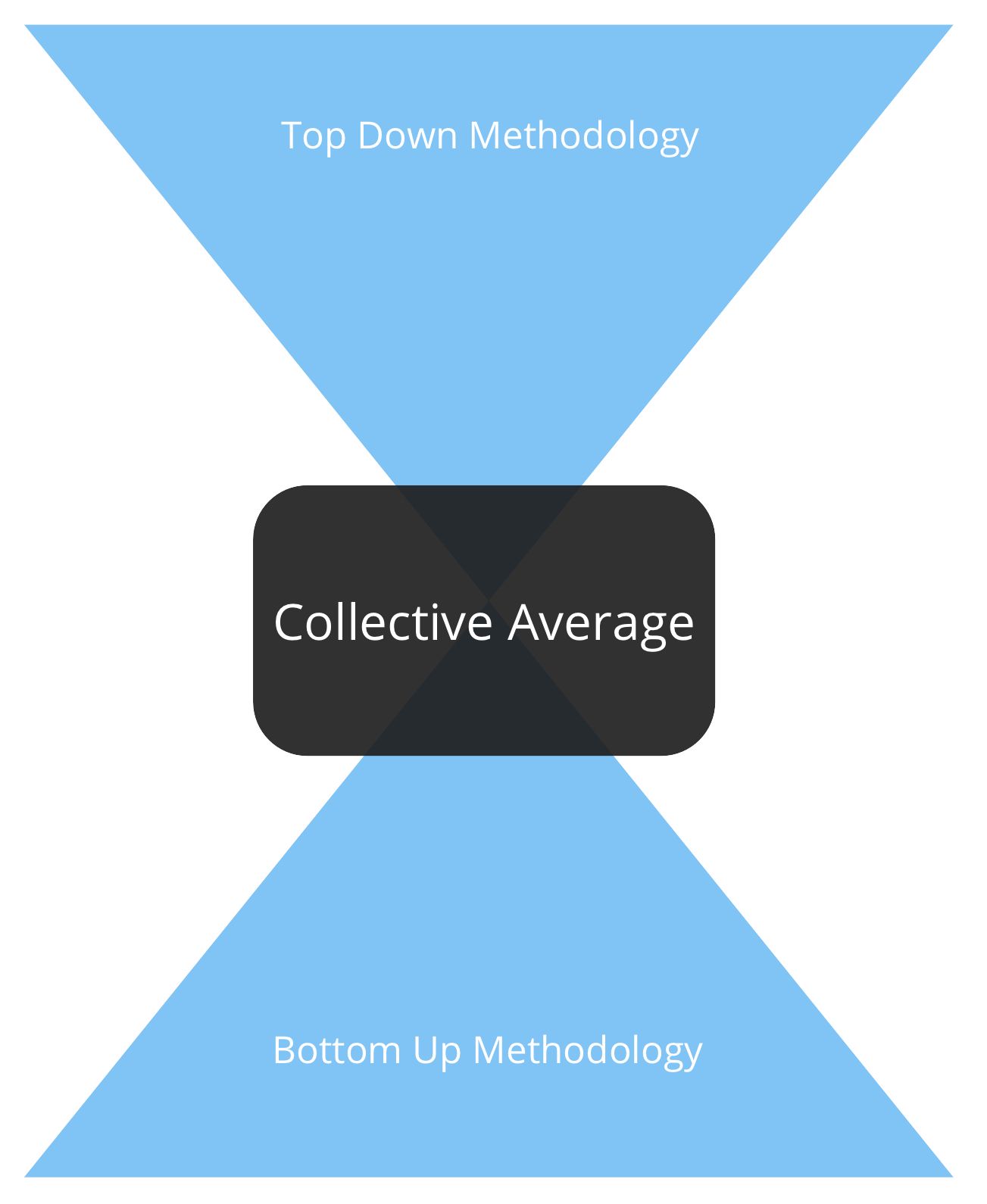

3. A Dual-Faceted Presentation to Investors

When courting investors, presenting both top-down and bottom-up estimations can be profoundly beneficial. Here's a suggested approach:

- Detail each estimation separately, elucidating the underlying data and the rationale behind your conclusions.

- Converge the two to present a median average, offering a balanced perspective.

Such a dual-pronged presentation serves twin objectives:

- It underscores your thoroughness in research, showcasing the depth of thought behind your market assumptions.

- It acts as a self-audit mechanism. Notable discrepancies between the two estimates can be a signal to re-evaluate the data sources or methodologies used.

In summation, while each estimation method has its merits, a synthesis of both can offer a well-rounded, credible perspective to potential investors.

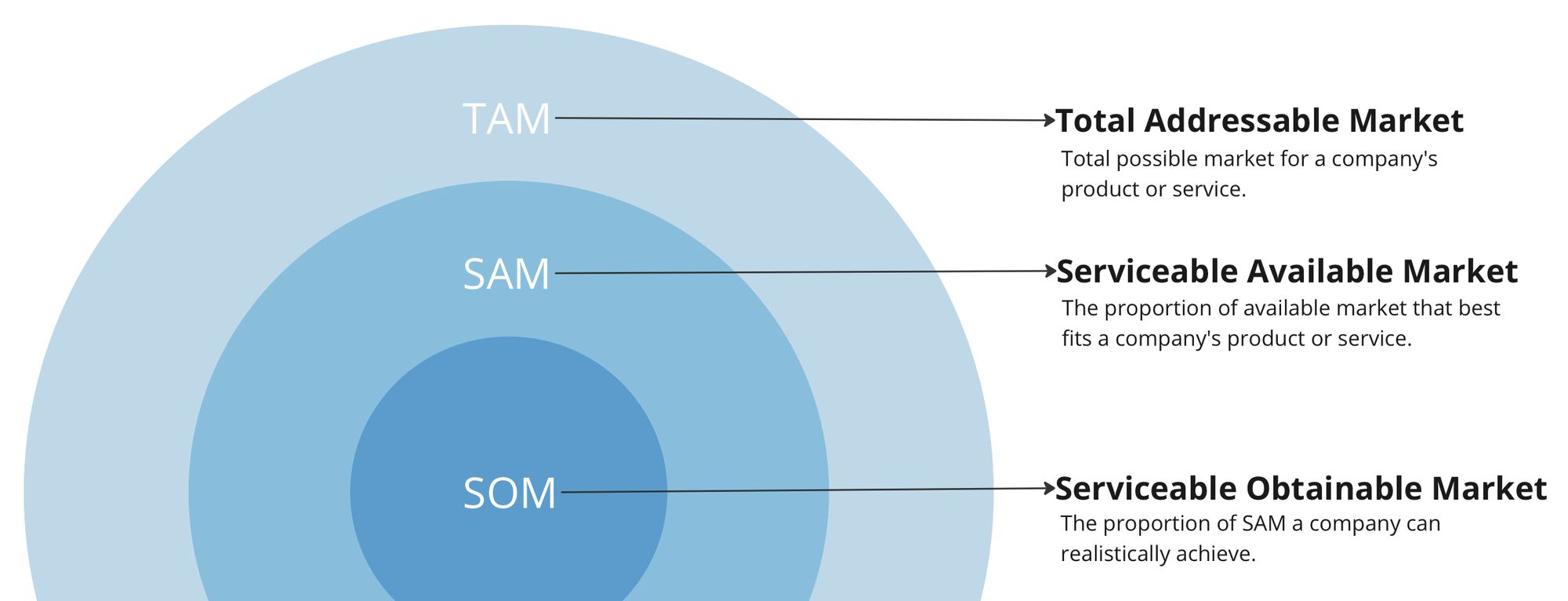

1. TAM (Total Addressable Market)

What is TAM?

TAM refers to the total revenue opportunity available for a product or service, assuming 100% market penetration. Think of it as the universe of potential.

Why is it Important?

From an investor's perspective, TAM signals the potential scale of a business. A large TAM can often compensate for early-stage inefficiencies, allowing startups the runway to pivot, evolve, and grow.

Venture Capital investors gravitate toward markets with over $1b for the chief reason that it can be reasonably presupposed that a start-up could acquire 10% of a huge market in 5 years. The larger the total market, the larger the 10% amounts to.

How to Calculate?

There are primarily two methods:

- Top-down: This typically involves starting with big industry research reports and narrowing it down to a specific segment. For instance, if global revenue for e-commerce is $3 trillion, and you're launching an online platform for handmade crafts, your TAM wouldn't be the entire $3 trillion, but rather a fraction of it.

- Bottom-up: This entails a more granular approach, often starting with primary data. For example, if there are 50 million crafters globally, and you expect to charge them $50 annually, your TAM would be 50 million x $50 = $2.5 billion.

2. SAM (Serviceable Addressable Market)

What is SAM?

SAM narrows down TAM to the segment that your product or service can actually serve, considering current or near-future constraints.

Why is it Important?

SAM provides a more immediate view of the market opportunity. Investors want to understand not just the vast potential, but the realistic chunk of the market that you can capture with your current capabilities.

How to Calculate?

Refining your TAM based on geographic regions you serve, distribution channels you have access to, and other limiting factors will give you SAM. If your handmade crafts platform only targets North America initially, then your SAM would be limited to the crafters in that region.

3. SOM (Serviceable Obtainable Market)

What is SOM?

Of the SAM, SOM is the portion you realistically aim to capture in the short to mid-term, factoring in existing competition, budget constraints, and other challenges.

Why is it Important?

SOM sets expectations. Investors often gauge early traction against SOM, not TAM or SAM. If you've acquired a significant portion of your SOM, it's a positive indication of product-market fit and execution capability.

How to Calculate?

Estimate based on initial sales, pilot projects, or early traction. If, after launching your platform, you reach 50,000 crafters in North America in the first year, this would be your initial SOM.

Guidance On Effectively Estimating Market Size

1. Ground Yourself in Reality

It's imperative to maintain a sense of realism. Your audience—be it investors, potential partners, or top talent—possesses a discerning eye. They've witnessed myriad pitches and evaluated numerous market claims. Approach them not with overinflated numbers, but with honest, fact-based estimations. Authenticity will serve you far better than bravado.

2. The Credibility of Your Data Matters

The bedrock of your TAM, SAM, and SOM calculations is the data from which they're derived. Ensure you're leveraging credible and up-to-date sources. If you've started generating revenue, your actual figures provide a valuable starting point. Otherwise, invest in thorough market research or turn to trustworthy, current resources. Your conclusions are only as solid as the data they're built on.

3. Stay On-Target and Demonstrate Your Commitment

Remember, when you present TAM, SAM, and SOM, you're not merely throwing out numbers—you're making a case for your startup's viability and potential for scale. Investor decisions hinge significantly on risk assessment. By furnishing a meticulous, fact-based market size, you're sending a clear message: you believe in your venture, are willing to do the legwork to validate it, and are primed for both immediate success and long-term growth. This dedication can be the very factor that sways investors to back your vision.

Final Thoughts

Accurate market sizing doesn't just "impress" investors—it equips you with insights to prioritize resources, refine strategies, and drive impactful results. Remember, every large market was once niche, and every behemoth startup once began with a singular focus. As you work towards turning your vision into reality, these metrics can serve as guiding stars.

While enlisting firms for specialized market research is a feasible route, I'd advocate for the entrepreneurial rigor of conducting preliminary research oneself. This not only equips you with deeper insights into market dynamics but also carves a clearer niche for your venture. Here are some avenues to guide your exploration:

Additional Resources

Delve into Online Analysis and Research

The digital realm is replete with analysts who closely monitor myriad sectors and product categories. By immersing yourself in their insights, you can:

- Gain a panoramic view of market performance.

- Access a reservoir of historical data.

- Trace overarching market trajectories and trends.

Harness the Power of Financial Reports

Publicly-listed competitors are treasure troves of data. Scrutinizing their financial performances can:

- Illuminate the competitive landscape.

- Facilitate rudimentary SAM and SOM analyses.

- Provide benchmarks, aiding in crafting aspirational goals for your venture.

Engage with Industry Stalwarts

Data, while invaluable, can sometimes paint an incomplete picture. Engaging in candid conversations with industry veterans or consultants can:

- Offer a richer, layered understanding of market segments.

- Unveil sub-categories within the primary market.

- Highlight segments that are inherently more receptive or 'friendly' to your offerings.

Leverage Market Research Tools

The online ecosystem boasts an array of tools designed to streamline market research. Leveraging these can enable you to:

- Conduct comparative analyses of companies.

- Decode customer search behaviors and the keywords driving traffic.

- Ascertain the digital footprint and origin of a company's online presence.

In conclusion, comprehending your market's expanse and nuances is both an art and a science. The resources outlined above can serve as your compass and guide.

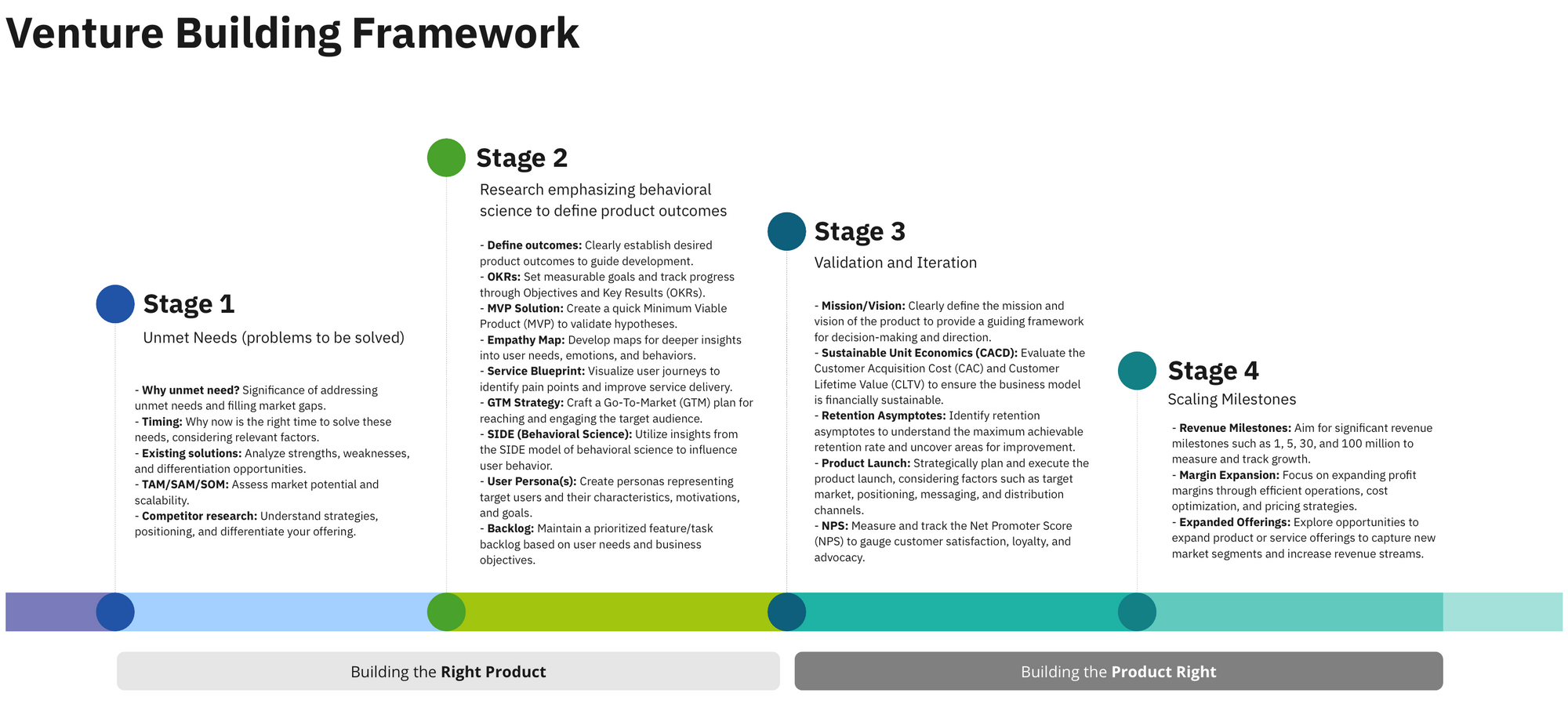

This artifact is part of Stage 1 of the Venture Buildinag Framework.

This is a powerful output as you work to ensure you are Building the Right Product.